A 1031 exchange is expensive and involves a confusing array of IRS-qualified as well as non-qualified costs. There are some 1031 exchange costs that are paid with sales proceeds that will result in taxable events. Operating costs including prorated rent, security deposits, maintenance, and insurance payments are among them. Others are excluded, including broker commissions, title closing fees, and qualifying intermediary fees.

We’ll go into detail about all of this so you’ll know what costs to budget for and how to minimize them. Options will be provided to you to prevent any threats to your exchange and also to reduce or do away with any taxable boot.

1031 Exchange

Although a 1031 exchange provides the typical real estate investor with a number of long-term advantages, it is important to take into account the associated expenditures. The average expenses of a 1031 exchange, like any other commercial transaction, vary based on the exchange provider, the number of properties, as well as the region of the properties.

A 1031 exchange typically costs between $600 and $1,200, with the majority of the expenditures coming from payments made to a Qualified Intermediary (QI). This price is for a conventional postponed exchange in which you sell the property you’ve given up and buy a new one. More complex 1031 exchange formats could include additional costs and hidden charges.

You should take into account the following factors while comparing 1031 exchange fees:

- fees for administration.

- upfront costs and setup.

- interest earnings (paid to you).

- interest earnings (kept by the intermediary).

- charges for each property.

- service fees or transaction costs.

- charges for qualified trust accounts.

What Is the Price of a 1031 Exchange?

The majority of the costs you will incur while performing a 1031 exchange typically take the shape of payments made to your licensed middleman. Expect to pay a total of $600 to $1,200 in exchange fees, on average. More significantly, you might need to budget for particular incidentals, such as overnight delivery costs.

Please be aware that the amount of money you will have to spend on exchange expenses and fees will increase the more complicated or comprehensive the 1031 exchange process is.

Qualified Intermediary Fees

Qualified intermediaries often take on the majority of the responsibilities in a 1031 exchange, hence they typically get paid more. Two-thirds of a QI’s income is frequently derived from actual interests in exchange funds. The normal cost to facilitate a delayed exchange is between $750 and $1250.

These costs are used to pay for the 1031 exchange’s administrative and qualifying costs. For every additional property in the trade, the majority of QIs will charge an additional $300–$400. Other companies may charge dependent on the value of the properties, but you can anticipate the cost to be in the aforementioned price range.

In addition, there is interest earned on the exchange fund accounts for a large portion of QI revenue. In a 1031 exchange, a QI is required to retain the selling proceeds of the property that was given up until you purchase the new property. The money that is being held can earn interest in a local bank or money market during this period. And a part or all of the revenue is kept by the QI.

Be prepared for certain QIs to ask for fees to cover transaction costs, particularly if the exchange is complicated or includes several assets. For transaction charges, QIs handling reverse exchange and construction often charge a few hundred dollars.

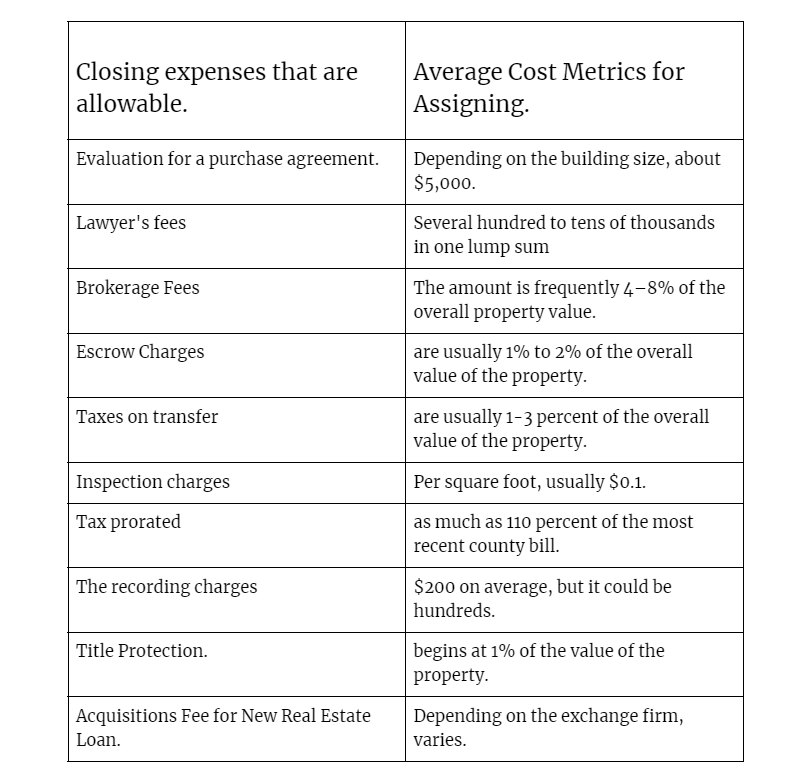

1031 Exchange Permitted Costs – 1031 Exchange Cost

To make the exchange procedure possible, a traditional 1031 exchange includes a number of fees. Even though these expenditures are a necessary component of the exchange procedure, some closing costs paid with the profits from sales or 1031 exchanges may or may not trigger a tax event for the exchangers.

The common closing expenses that are allowed in a 1031 exchange, together with associated cost-assigning measures, are listed below:

Setup, administrative costs, and costs per property

Institutional qualified intermediaries often charge a setup or administrative fee for each 1031 exchange transaction in the range of $850.00 to $1,200.00. Usually, this price covers one selling property (sometimes known as a “relinquished property”) and one purchase asset (“replacement property”). For each additional property handled in the tax-deferred exchange, you also typically pay an extra property administration cost of $300 to $400.

The set-up or administrative costs charged by non-institutional qualified intermediaries are generally between $600.00 and $800.00, which makes them look more affordable than institutional qualified intermediaries. To genuinely evaluate 1031 exchange service providers, as well as the company’s financial soundness, you must take into account all additional expenses and fees.

Earned Interest on 1031 Exchange Funds

A qualified intermediary’s tax-deferred exchange income is often only made up of around one-third of setup and administrative costs. About two-thirds of the 1031 exchange income is made up of interest income that is produced and kept on the money used in the 1031 exchange. While your tax-deferred exchanging funds are on deposit with or being held by a qualified intermediary, the qualified intermediary will keep everything or a part of the interest payments received on those funds.

Actually, paying your qualified intermediary for said tax-deferred exchange services provided on your behalf using this fee structure is quite fair and effective. Your qualified intermediary is exposed to greater risk. The amount of interest revenue kept by your qualified intermediary rises directly in proportion to the size of the transaction.

To accurately grasp the overall fee for the service you will be paying to your qualified intermediary, you must compare apples to apples by comparing the amount that will be paid to you and the amount that will be kept by the qualified intermediary.

Service and/or transaction fees.

Most qualified intermediary fee arrangements are limited to a setup charge and a percentage of interest revenue. For more intricate transactional structures, such as seller carry-back financing, there are additional fees.

It is vital to know and understand the whole pricing structure before making a final decision on your qualified intermediary. Only a few lesser qualified intermediaries might charge different transactional fees, such as bank transfers fees, delayed delivery or courier fees, facsimile expenses, etc.

Costs of Delayed 1031 Exchange

The price of non-institutional middlemen is usually lower. For a delayed exchange, the median 1031 exchange facilitator charge is between $800 and $1,200 for organizational intermediaries and between $600-$800 for non-institutional intermediaries.

This charge often covers the qualification, lodging, and administrative expenses associated with finishing a 1031 exchange. Other service charges such as messengers, document preparation, declarations, processing, and notary charges are also included.

Additionally, the additional property charge might be between $300 and $400 if you choose to sell or buy other properties.

The opportunity cost incurred when your QI holds the interest that has accumulated on your escrowed monies is another important consideration. With 180 days passing between the sale of your abandoned property and the closing on the replacement, this may be important. The interest of $5,000 is accumulated on the net earnings of $500,000 at a rate of 2%.

Interest could be used to pay for other expenditures rather than the QI. But then anticipate a larger QI charge. It is something to take into account when choosing your QI and writing the contract. Just remember to include accumulated interest when calculating costs.

In conclusion, exceptional restrictions particular to your trade may incur extra costs.

Costs of a Reverse 1031 Exchange

If you do a Reverse or Construction 1031 exchange, be prepared to spend significantly more. In a reverse exchange, as the name suggests, you purchase the replacement prior to actually selling your given property.

Due to greater complexity, fees may be multiplied. It is frequently used in markets where there are more buyers than sellers of real estate. Your prospects of finding acceptable replacement property may be improved if you are not confined by the 45-day regulation that restricts the identification time of the 1031 exchange property.

Significantly, when replacements are bought before selling your old home, no interest revenue is collected. Typically, QIs will charge between $3,000 and $8,000 for the reverse exchange. This results in higher out-of-pocket expenses but no lost interest.

Can 1031 Exchange Fees be Minimized?

Yes, performing a 1031 exchange gets expensive. However, keep in mind that the majority of these expenses include broker commissions, appraisal charges, finders fees, taxes, and title fees.

In any case, you should anticipate having to pay those costs when buying or selling real estate. The one-time qualified intermediary cost, which starts at less than $1,000 for a single asset delayed exchange, appears to be very reasonable.

Separating costs payable with exchange money from those that do not qualify is a crucial aspect. Tax professionals typically advise paying out-of-pocket for non-qualified costs. Your 1031 goal of deferring taxes is met by avoiding taxable boot with this exchange.

Tax deferrals, after all, may amount to hundreds of dollars or more. Last but not least, we must remain focused on the main objective of acquiring excellent replacement homes at a reasonable cost.

Your tax advisor/CPA and a trustworthy qualified intermediary will assist you in organizing your 1031 exchange charges. The experts at 1031 exchange businesses will work with you to determine which charges, given your unique circumstances, you can or cannot avoid in order to fully comply with IRS regulations and maximize your transactional benefits.

NNN Deal Finder is a one-stop shop for commercial property investors that is connected with the best 1031 exchange companies around the USA. Get in touch with us right away to arrange a meeting with the top experts and get your exchange handled efficiently and safely.